🔥LP Burnt

or "Liquidity Pool BURNT"

Another key thing to watch out for is liquidity pools, and importantly... whether the creator is able to access it!

What is a liquidity pool?

A liquidity pool is a crucial element in the world of decentralized finance. In simple terms, it's a pool of money that lets you buy and sell any coin you've purchased through BONKbot!

Here's how it works:

Creation of the Pool:

The developer creates a new token (e.g., $CatCoin).

They pair this token with an established cryptocurrency like Solana ($SOL) in the liquidity pool.

How It Works:

Users can trade $CatCoin and $SOL within this pool.

This system ensures there's always liquidity (availability of funds) for trading, making it easy for anyone to buy or sell their tokens.

Benefits of Liquidity Pools

Liquidity pools are a fantastic invention for a few reasons:

Decentralized Trading: They allow trading without needing a central exchange.

Access to Any Coin: Anyone can trade any coin that's part of a liquidity pool.

Potential Risks with Liquidity Pools

While liquidity pools are great, there are some risks to be aware of.

The Risk of Liquidity Pools

Imagine you have $SOL, a valuable token. Would you trade it for something that could drop to zero in value instantly? Probably not. Here’s why you need to be cautious:

Control of the Liquidity Pool:

When a liquidity pool is created, the developer gets a special token called an SPL (Solana Program Library token).

This SPL token indicates ownership of the liquidity pool.

Risk of 'Rug Pulls':

If the developer retains control of the SPL token, they can withdraw all the funds from the liquidity pool in one move.

This action, often called a 'rug pull,' can make your token worthless.

How to Protect Yourself

Before buying into any new token, it's important to do your research:

Check if the Liquidity Pool is 'Burnt':

You can use platforms like BirdEye or rugcheck.xyz to see if the liquidity pool is burnt.

If the liquidity pool is burnt, it means the developer can’t withdraw the funds, making your investment safer.

Example of a Non-Burnt Liquidity Pool:

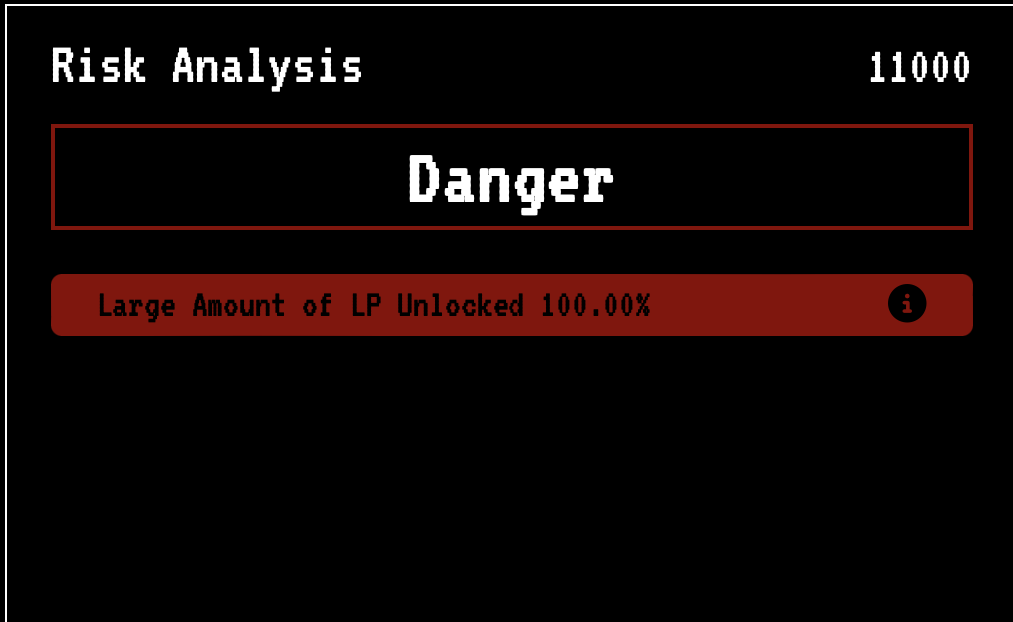

This is what it looks like if the liquidity pool is not burnt when you search the coin on rugcheck, meaning the developer still has control over the funds.